News

Legal Protection for Home Buyers in Singapore

-

A Licensed Housing Developer can only sell the building project before construction after they have obtained the following:

-

Building Plan Approval from Commissioner of Building Control

-

Developer's Sale Licence from Controller of Housing.

-

A Licensed Housing Developer is required to use the standard ‘Option to Purchase’ and ‘Sale & Purchase Agreement’ forms prescribed under the Housing Developers’ Rules for the sale of uncompleted housing units.

-

Once buyer has entered into an agreement, buyer’s lawyer will prepare and lodge a caveat with SLA on their behalf.

-

A Licensed Housing Developer is required to open and maintain a Project Account for the building project with a bank or financial institution. It is required to:

-

deposit forthwith upon receipt all instalments of purchase money (including the booking fee) payable by a purchaser towards the purchase of a unit in a building project prior to the grant of the temporary occupation permit by the competent authority for the unit, including any instalment of purchase money payable by the purchaser towards the purchase of the unit upon the grant of the temporary occupation permit, into the Project Account of the building project.

-

deposit any loan for the construction of a building project into the Project Account of the building project.

-

A Licensed Housing Developer can withdraw monies from the Project Account related to the building project only.

-

Buyers can move to their new homes after Temporary Occupation Permit (TOP) is obtained by Commissioner of Building Control. There is a defect liability period of 12-month warranty period from the date of notice is served for you to take possession of the property.

Purchase under the Housing Developers' Rules for uncompleted condo projects:

-

You will first need to pay a booking fee which is 5% of the purchase price for the exchange of the Option to Purchase.

-

Within 14 days after the buyer has paid the booking fee, Developer will deliver the Sale and Purchase Agreement and title deeds of the Property to the buyer or the buyer lawyer.

-

Buyers have to sign all the execution copies of the Sale and Purchase Agreement and return to developer within 3 weeks from the date of the delivery to the buyers.

-

Buyers who exercises this Option shall pay the developer being 20% of the Purchase Price less the Booking Fee, within 8 weeks after the date of this Option.

-

The buyer has to pay stamp duties to the Inland Revenue of Singapore within 14 days of signing the Sale & Purchase Agreement. The stamp fee payable is normally calculated as 3% of the purchase price less S$5,400.

-

If the buyer does not exercise this Option before it expires, Developer will forfeit 25% of the Booking Fee and refund the balance 75% of the Booking Fee.

Stamp Duty

Buyer Stamp Duty

Buyer Stamp Duty (BSD) is a tax on documents relating to the purchase of property. It has to be paid within 14 days of signing the Sale & Purchase Agreement. The stamp fee payable is normally calculated as 3% of the purchase price less S$5,400.

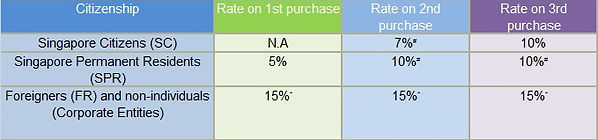

Additional Buyer Stamp Duty (ABSD)

On 11 Jan 2013, the Government announced the revised Additional Buyer Stamp Duty (ABSD) rates applicable to purchases or acquisitions of residential properties on or after 12 Jan 2013.

Buyer has to pay the ABSD in addition to the BSD.

#Whether owned wholly, partially or jointly with others.

*Entity means a person who is not an individual, and includes an unincorporated association, a trustee for a collective investment scheme when acting in that capacity, a trustee-manager for a business trust when acting in that capacity and, in a case where the property conveyed, transferred or assigned is to be held as partnership property, the partners of the partnership whether or not any of them is an individual.

For more information on Stamp Duty

Seller Stamp Duty (SSD)

On 13 January 2011, the Government announced the extension of the holding period for imposition of Seller Stamp Duty (SSD) on residential properties from 3 years to 4 years based on new rates. The new SSD rates will be imposed on residential properties which are acquired (or purchased) on or after 14 January 2011 and disposed of (or sold) within 4 years of acquisition, as follows:

-

Holding period of 1 year : 16% of price or market value, whichever is higher

-

Holding period of 2 years : 12% of price or market value, whichever is higher

-

Holding period of 3 years : 8% of price or market value, whichever is higher

-

Holding period of 4 years : 4% of price or market value, whichever is higher

Properties acquired before 20 Feb 2010 will not be subject to SSD.

For more information on Seller Stamp Duty